Capital gains yield calculator

Short-term capital gains tax rates are generally higher than long-term capital gains tax rates. And this other Taxable Income helps determine what tax brackets the capital gains will be in.

Capital Gain Formula Calculator Examples With Excel Template

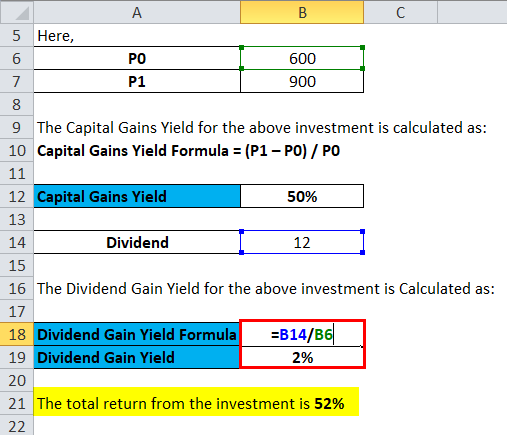

CGY Current Price Original Price Original Price x 100.

. Simply divide your rental income by the property value and then multiply it by 100 to get your rental yield expressed as a percentage. Hi Nissar If you wish to claim exemption from Long Term Capital Gains LTCG tax you have to invest your capital gains within six months from the date of sale of your property or before the due date of filing income tax return usually 31st July in notified capital bonds issued by the National Highways Authority of India NHAI or Rural. So for 2022 the maximum you could pay for short-term capital gains on rental property is 37.

The usual high-income tax suspects California New York Oregon Minnesota New Jersey and Vermont have high taxes on capital gains too. Get 247 customer support help when you place a homework help service order with us. The Capital Gains Tax allowance on property for 2022 - 2023 is 12300.

Simply enter your total earnings the sale and purchase price of the property and your tax. Using the home sale exclusion the seller could exclude 250000 of the profit. Taxes capital gains as income and the rate reaches 575.

Annual rental income value of the property x 100 rental yield. The tax traps wealth in an investment vehicle requiring special techniques to free the capital without penalty. For short-term capital gains youd be at 24.

Capital gains taxes apply to the sale of stocks real estate mutual funds and other capital assets. A good capital gains calculator like ours takes both federal and state taxation into account. 100000 at a NAV of Rs.

Our Capital Gains Tax calculator gives you an estimate of how much you could have to pay in Capital Gains Tax CGT when you sell your property in the UK. The long-term capital gains tax rate for assets held for more than one year depends upon your taxable income. How to Work Out Rental Yield.

Long-term capital gains are taxed at 0 15 and 20 depending on your taxable income. Understanding Capital Gains and the Biden Tax Plan. Check Cost Inflation Index Tax Exemptions.

The potential capital gains tax on the sale would be 300000 which is the profit made from the sale. For example if you earn 100000 a year youre in the 15 tax bracket. As a result they might put you in a different tax bracket compared to short-term capital gains.

A capital gains tax CGT is a tax on the profit realized on the sale of a non-inventory asset. The table below breaks down 2022 short-term capital gains tax rates by filing status. Short-term capital gains taxes tend to be higher than long-term capital gains taxes so your investment may yield a lower return than your expected ROI.

Were going to get rid of the loopholes that allow Americans who make. Weve got all the 2021 and 2022 capital gains tax rates in one. Idaho axes capital gains as income.

Long-term capital gains are taxed at lower rates than ordinary income while short-term capital gains are taxed as ordinary income. This is done to encourage investors to hold investments for a longer period of time. Your total taxable gain or net profit is.

10 and decided to redeem the same in July 2019 say at a NAV of Rs. Multiple ways are available to. The capital gains tax is economically senseless.

New Hampshire doesnt tax income but does tax dividends and interest. A capital gains tax is a type of tax levied on capital gains profits an investor realizes when he sells a capital asset for a price that is higher than the purchase price. You would owe capital gains taxes on 190000 the difference between your purchase price and your sale price.

Formula for calculating rental yield. For most people if they realize capital gains they have other income for the year as well normal wages etc. Taxes capital gains as income and the rate is a flat rate of 3.

Capital Gains Tax Allowance on Property. In a hot stock market the difference can be significant to your after-tax profits. Suppose Amit had invested in debt-oriented mutual funds in April 2016 and the investment amount was Rs.

However a theoretical capital yield of 4 is taxed at a rate of 30 so 12 but only if the savings plus stocks of a person exceed a threshold of 25000 euros. Following on from the previous example. This will be raised to a threshold of 30000 euros in 2018 together with other.

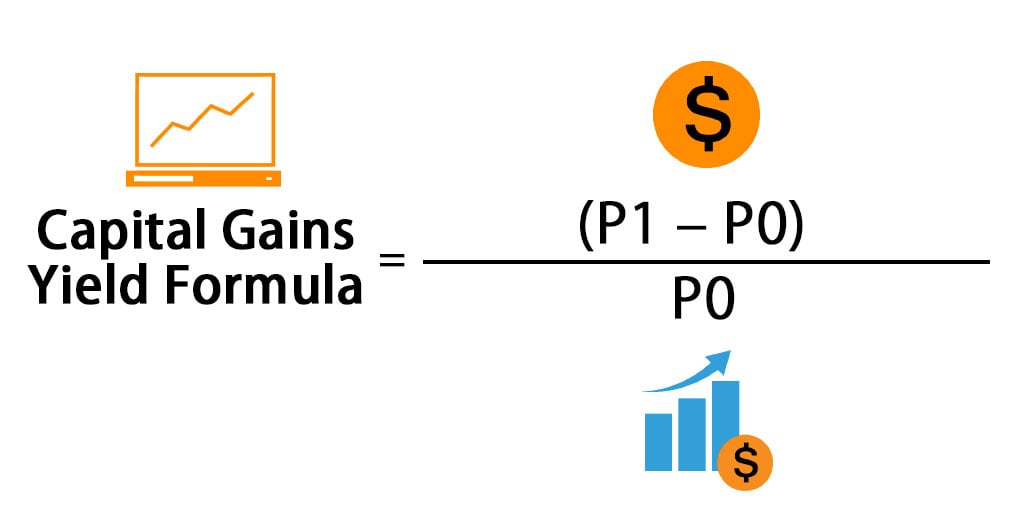

Capital Gains Yield Formula. As a mortgage broker were not able to offer tax advice. We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply.

Working out the rental yield for a property is very easy to do. This means you dont pay any CGT on the first 12300 you earn from the sale of your property. Long-term capital gains are taxed at a lower rate than short-term gains.

In the above case the gains arising from the sale will be considered as long term capital gain and the benefit of. Elevate your Bankrate experience. Taxes capital gains as income and the rate reaches 660.

This calculator has been produced for information purposes only. This will affect long-term and short-term capital gains since both would be taxed as ordinary income in the highest bracket. The rate reaches 693.

Capital Gains Taxes on Property. Biden proposed raising the top capital gains tax from 20 to 396 before a joint session of Congress on April 28. Procedure to Calculate CG for Short Long term with Simple example.

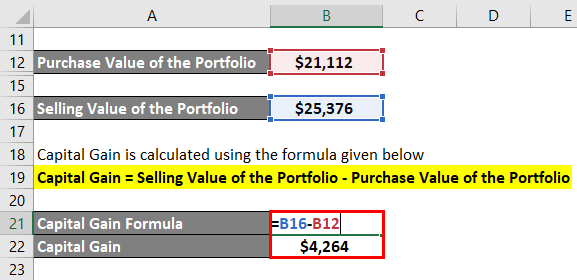

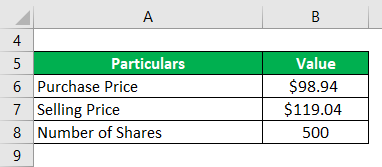

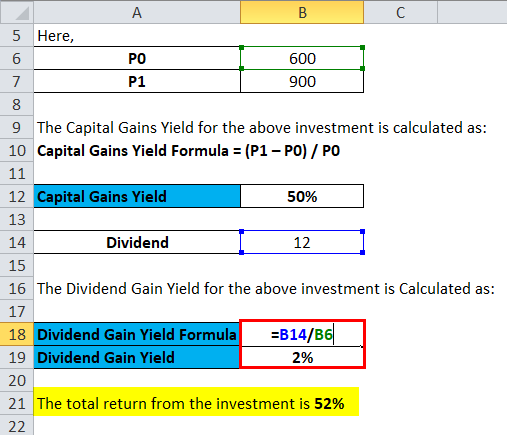

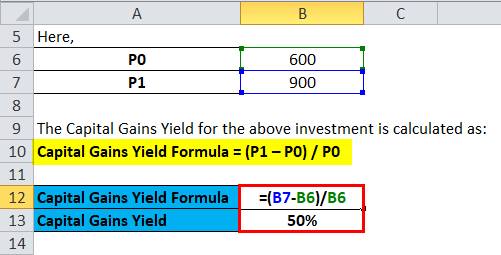

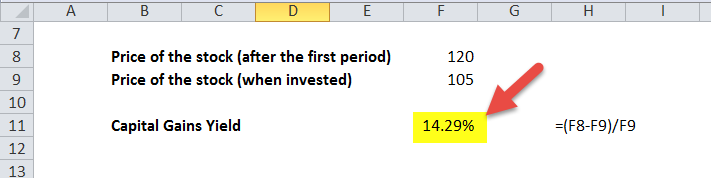

Illustration of Long Term Capital Gain Tax Calculation. Capital Gain is the component of total return on an investment which occurs as a result of a rise in the market price of the security. Below is a screenshot of the formula used to calculate CGY the same numbers as the example above.

You sell it today for 450000. Get insider access to our best financial tools and content. The short-term capital gains tax rate is whatever your normal income tax rate is and it applies to investments you hold for less than one year.

The tax is based on the profit you made the price you sold it for minus the price you paid and how long you held onto the asset. To apply the home sale exclusion your property must pass two tests. Capital Gains Tax Calculator.

The difference between your Purchase Value and Sale Value is the capital gain on your investment. Capital Gains Tax. Taxes capital gains as income and the rate is a flat rate of 495.

Since your ordinary income tax bracket is 22 by taking advantage of the lower capital gains tax rates you saved 70 in taxes 150 versus 220 on a 1000 capital gain. Long-term capital gains that is gains on assets held for a at least a year are generally taxed at a much lower rate than earned income money that you get from working. And consequently owe the remaining 50000 in capital gains.

/dotdash_Final_Tax_Equivalent_Yield_Nov_2020-01-c528a1d54d4f48f19113104ac3291de1.jpg)

Tax Equivalent Yield Definition

Capital Gain Formula Calculator Examples With Excel Template

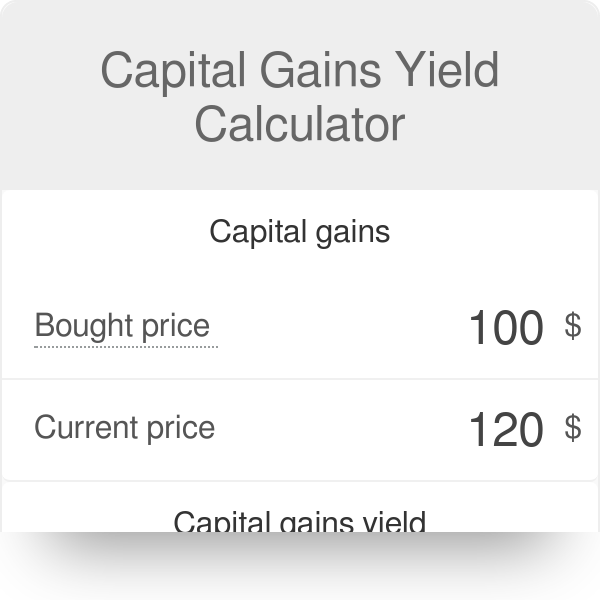

Capital Gains Yield Formula With Calculator

Capital Gain Formula Calculator Examples With Excel Template

Capital Gains Yield Cgy Formula Calculation Example And Guide

Gain Formula How To Calculate Gains Step By Step Examples

Capital Gains Calculator Hot Sale 57 Off Www Wtashows Com

Yield Definition Overview Examples And Percentage Yield Formula

Capital Gains Tax Calculator For Relative Value Investing

Capital Gains Calculator Hot Sale 57 Off Www Wtashows Com

Capital Gain Formula Calculator Examples With Excel Template

Capital Gains Yield Calculator Calculate Price Gains

Gain Formula How To Calculate Gains Step By Step Examples

Capital Gains Calculator Hot Sale 57 Off Www Wtashows Com

Capital Gains Calculator Hot Sale 57 Off Www Wtashows Com

Capital Gains Calculator Hot Sale 57 Off Www Wtashows Com

Capital Gains Calculator Hot Sale 57 Off Www Wtashows Com