46+ what credit score is needed to get a mortgage

Web All conventional and federally backed mortgage options have a minimum credit score requirement to qualify. Web If youre trying to get a mortgage your credit score matters.

46 Credit Score Statistics And Faqs For 2022 Screen And Reveal

Because a bad credit score can raise red flags for lenders it can be easier for a home buyer to qualify for a mortgage with no credit rather than bad credit.

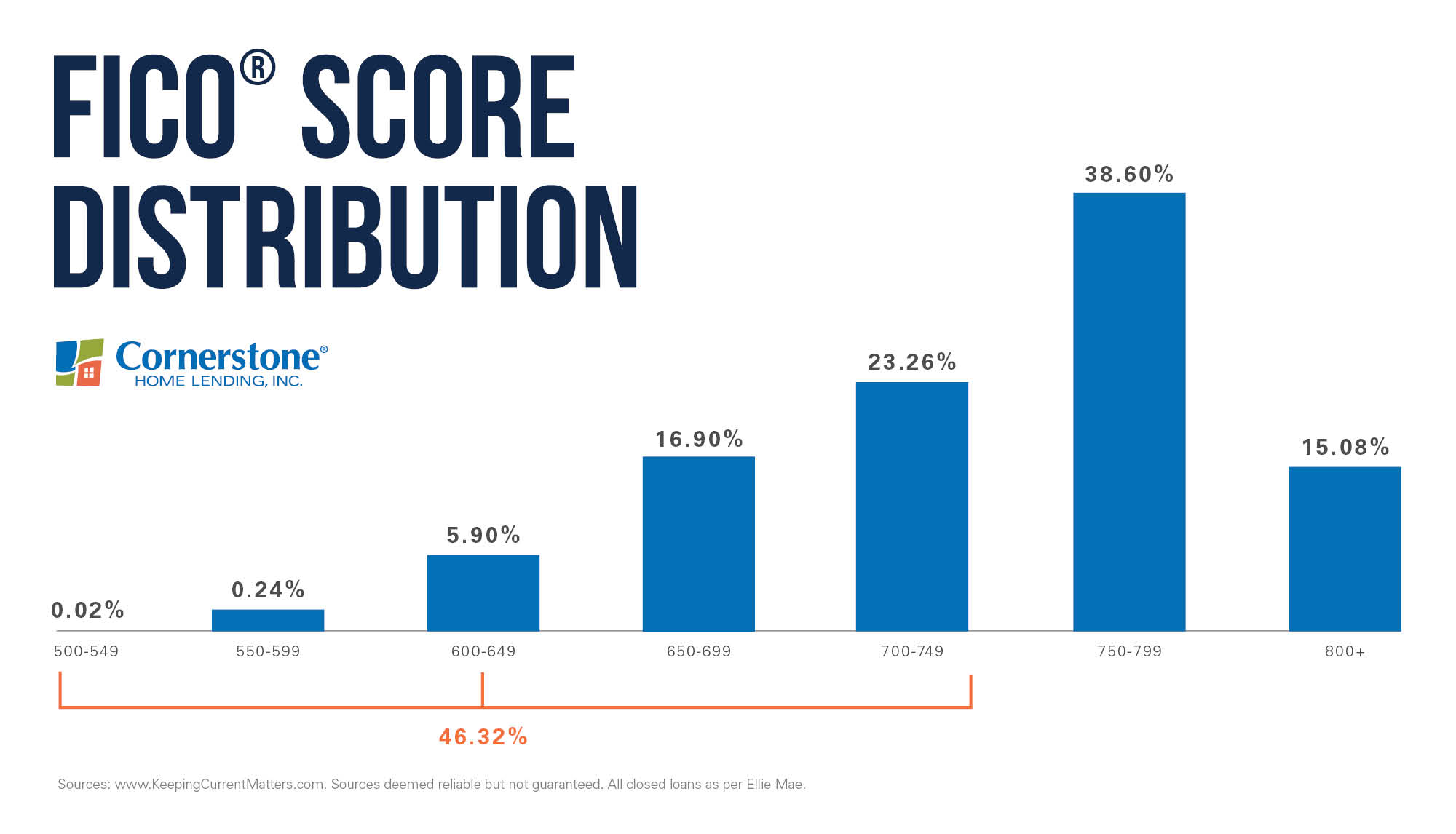

. Web Going into 2023 the minimum credit score needed to get approved for a mortgage is 640. Web As of September 2020 the average home buyer who obtained a conventional purchase mortgage had a FICO Score of 759 according to Ellie Mae -- a score largely considered to be great credit. Web Different mortgage types have different minimum score requirements.

Mortgage lenders use credit scores as well as other information to assess your likelihood of repaying a loan on time. Borrowers with scores under 650 tend to. The credit score you need to refinance depends on the mortgage lender you work with your individual situation and often the type of refinance you.

Web For most loan types the credit score needed to buy a house is at least 620. No minimum but it is advisable to have a score above 620. Web Most lenders require a minimum credit score of 640 for USDA loans.

Although it would be more accurate to say what credit score range you need. Applicants with credit scores of 580 or greater can qualify with a down payment as low as 35. Web The minimum credit score to get a mortgage is 580 which is considered only fair And with a score of 620 or above you have access to most home loan programs.

Web Most lenders require a 740 credit score or higher to qualify for the lowest mortgage interest rates so anything above 740 is considered a very good score to buy a house. Armed with this score you can secure a more affordable monthly payment and have more buying power when making purchase offers. Anywhere between 620 and 680 would be considered a minimum depending on the lender.

What Can Impact The Minimum Credit Score Needed For A Mortgage in Canada. Your target minimum credit score should be a 620 FICO or higher. However a higher score significantly improves your chances of approval.

There is no minimum FICO Score though to qualify for an FHA loan that requires a down payment of 10 or more but some lenders may set. Web You might be surprised at the minimum credit score to buy a house. No minimum but scores above 640 are most successful with lenders.

What Credit Score Is Needed for a USDA Loan. However if you have a good credit score from one of the main credit reporting reference agencies such as Experian you are likely to have a good credit score with your lender. Web A conventional mortgage usually requires a minimum credit score of 620.

Compare Loan Qualification Requirements The. Web If your score is between 580 and 619 you probably have no choice but to go with an FHA mortgage. Web The credit score you need to get a mortgage varies as theres no one credit score or universal magic number.

But lenders wont be offering you the best interest rates out theresome experts suggest that you need score of 760 to get those. That means looking at your credit report. Rocket Mortgage does not offer USDA loans at this time.

Web A poor credit score is often defined as a score below 600 on a 300 850 scale. Web Keep this in mind when youre trying to figure out what credit score you need to get a mortgage. Web The minimum credit score needed for most mortgages is typically around 620.

However government-backed mortgages like Federal Housing Administration FHA loans typically have lower credit requirements than conventional fixed-rate loans and adjustable rate mortgages ARMs. If youre looking for a mortgage that requires a minimum credit score of 580 you may need your middle score to be at least 580. 500 if you can put down 10.

With a 620 credit score your credit score will qualify for all conventional and government backed mortgages. Web When a loan officer gets your mortgage application they may use a pricing grid to figure out how your credit scores affect your interest rate says Yves-Marc Courtines a chartered financial analyst with Boundless Advice. Web You can get an FHA mortgage with a FICO Score as low as 500 but applicants with scores ranging from 500 to 579 must make a down payment of at least 10 to qualify.

Fannie and Freddies policies pretty much exclude anyone with a score below 620 from a. On paper mortgages backed by the Federal Housing Administration otherwise known as FHA loans allow a minimum credit. If your credit score falls into this category you may find that some lenders are reluctant to extend credit.

This means that with a score of 684 you have a high probability of being approved for a mortgage loan. Understanding Your Credit Score Once you have a basic understanding of what credit score is needed for each type of loan its time to take your own score into consideration. Generally higher scores can mean a lower interest rate and vice versa.

580 if you want to put down 35. Web No credit minimum from USDA but 640 is common. Web Youll need a minimum credit score of 580 to qualify for an FHA loan that requires a down payment of just 35.

Free Report Sample Creditregistry Creditconnection

What Credit Score Is Needed For A Mortgage Homeownership Hub

What Credit Score Do You Need To Buy A House Nerdwallet

What Credit Score Do You Need To Buy A House Nerdwallet

How To Get A Home Loan With Bad Credit In New York

How Your Credit Score Affects Your Mortgage Rates Forbes Advisor

What Credit Score Do You Need To Buy A House Rocket Mortgage

Dvvek9eupi Gum

Here S What To Know About Turo And Credit Scores

What Credit Score Is Needed To Buy A Home

What Credit Score Do I Need To Get A Mortgage Haysto

Here S What To Know About Turo And Credit Scores

Credit Score Needed To Get A Home Loan Credible

Minimum Credit Score For Mortgage March 2023

The Results Are In What S The Ideal Credit Score For A Mortgage

Credit Score Requirements To Buy A House 2023 Guide

Almost 30 Percent Of Americans Unlikely To Get A Mortgage Zillow Research